Discount notes issued by Freddie Mac, for example, have maturities that range from overnight to one year. The notes are issued and maintained in book-entry form through the Federal Reserve Bank of New York, and investors may acquire the notes in denominations as small as $1,000. On November 1, 2018, National Company obtains a loan of $100,000 from City Bank by signing a $102,250, 3 month, zero-interest-bearing note. National Company prepares its financial statements on December 31, each year. On November 1, 2018, National Company obtains a loan of $100,000 from City Bank by signing a $100,000, 6%, 3 month note. There are many examples of discounted note, but zero interest notes are most common.

Short-Term Note Payable – Discounted

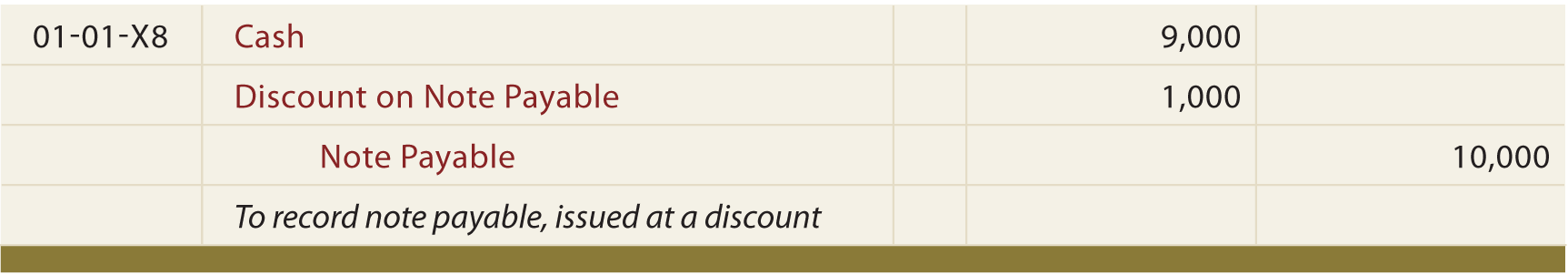

The company obtains a loan of $100,000 against a note with a face value of $102,250. The difference between the face value of the note and the loan obtained against it is debited to discount on notes payable. The notes payable are not issued to general public or traded in the market like bonds, shares or other trading securities.

On the date of receiving the money

It is important to realize that the discount on a note payable account is a balance sheet contra liability account, as it is netted off against the note payable account to show the net liability. The long term-notes payable are classified as long term-obligations of a company because the loan obtained against them is normally repayable after one year period. They are usually issued for buying property, plant, costly equipment and/or obtaining long-term loans from banks or other financial institutions.

Why would you issue a note payable instead of taking out a bank loan?

These notes are called zero interest, but they do carry an implicit interest rate figured into the face value of the note. The principal of $10,475 due at the end of year 4—within one year—is current. The principal of $10,999 due at the end of year 5 is classified as long term.

Do you own a business?

He became a member of the Society of Professional Journalists in 2009. Intermediate Financial Accounting 2 Copyright © 2022 by Michael Van Roestel is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted. All these components play a vital role in making appropriate journal entries. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

They are usually issued for purchasing merchandise inventory, raw materials and/or obtaining short-term loans from banks or other financial institutions. The short-term notes may be negotiable which means that they may be transferred in favor of a third party as a mode of payment or for the settlement of a debt. The short-term notes are reported as current liabilities and their presence in balance sheet impacts the liquidity position of the business. The date of receiving the money is the date that the company commits to the legal obligation that it has to fulfill in the future. Likewise, this journal entry is to recognize the obligation that occurs when it receives the money from the creditor after it signs and issues the promissory note to the creditor.

- National Company prepares its financial statements on December 31, each year.

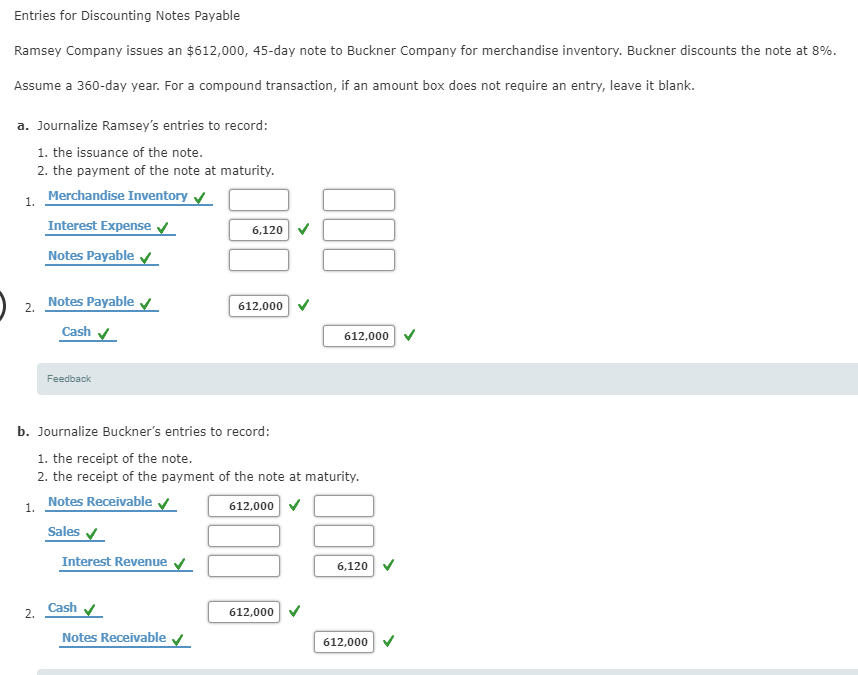

- To accomplish this process, the Discount on Notes Payable account is written off over the life of the note.

- In this case the note payable is issued to replace an amount due to a supplier currently shown as accounts payable, so no cash is involved.

In examining this illustration, one might wonder about the order in which specific current obligations are to be listed. One scheme is to list them according to their due dates, from the earliest to the latest. Another acceptable alternative is discount on notes payable to list them by maturity value, from the largest to the smallest. For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

It is common knowledge that money borrowed from a bank will accrue interest that the borrower will pay to the bank, along with the principal. The present value of a note payable is equivalent to the amount of money deposited today, at a given rate of interest, which will result in the specified future amount that must be repaid upon maturity. The cash flow is discounted to a lesser sum that eliminates the interest component—hence the term discounted cash flows. The future amount can be a single payment at the date of maturity, a series of payments over future time periods, or a combination of both. The cash flow is discounted to a lesser sum that eliminates the interest component—hence the term discounted cash flows. The short term notes payable are classified as short-term obligations of a company because their principle amount and any interest thereon is mostly repayable within one year period.

Thus, S. F. Giant receives only $5,000 instead of $5,200, the face value of the note. With a promissory note, the business who issued the note (called the issuer) promises in writing, to pay an amount of money (principal and interest) to a third party (called the payee) at a given time or on demand. The price discount received by the bondholder at maturity can also be taken as the imputed interest earned on the bond.